The 200-Day Moving Average Reclaim: A Case Study in Trend Reversals

A guide to trading S&P 500 trend reversals using the 200-day moving average and market breadth.

In technical analysis, few signals carry as much weight as the 200-day moving average (200DMA). It acts as the dividing line between long-term bull and bear markets for institutions and retail traders alike.

But signals are rarely crystal clear in the moment. They often arrive amidst “macro noise” like fears of inflation, geopolitical tension, or policy shifts that make pulling the trigger difficult.

In this guide, we will break down exactly what a “200DMA Reclaim” is, why it matters, and analyze a specific historical example. We will look at the May 2025 reclaim which kicked off a massive rally despite a “wall of worry.”

What Is the 200-Day Moving Average?

The 200-day moving average (200DMA) is the average closing price of a stock or index over the past 200 trading days, or about 10 months. It smoothes out short-term volatility to reveal the dominant long-term trend.

Price > 200DMA: generally signals a bullish trend and institutional accumulation.

Price < 200DMA: generally signals a bearish trend and distribution.

As John Murphy noted in Technical Analysis of the Financial Markets, this line acts as a major support or resistance level. When the price crosses it, the market is making a statement.

The Anatomy of a “Reclaim”

A reclaim occurs when the S&P 500 trades below this key level but then powers back above it. This crossover often signals a potential trend reversal or renewed market strength.

However, context is everything. Not all reclaims stick. The most reliable reclaims typically have three characteristics:

Breadth: A majority of individual stocks are participating in the move.

Volume: The move is supported by institutional buying (high volume).

Persistence: The index closes above the line for multiple consecutive days.

Case Study: The May 2025 Reclaim

Let’s look back at a textbook example from earlier this year.

The Setup (May 23, 2025) The S&P 500 had been chopping in a corrective phase. Sentiment was fearful. Headlines were dominated by renewed trade tensions and policy comments regarding tariffs. The VIX (volatility index) was edging higher.

Technically, however, the picture was improving. On May 23, the S&P 500 closed at 5,802.82, crossing back above its 200DMA (which was then at ~5,773).

At the time, we noted several bullish confirmations in TradeRounds:

Momentum: The MACD was in bullish territory and RSI was above 50.

Breadth: Over 50% of S&P 500 stocks were trading above their own 200DMAs.

Structure: Short-term averages (20-day and 50-day) were sloping upward.

The “Wall of Worry” Despite the technical buy signal, it was difficult to be bullish. Macro headwinds were front and center. Many investors stayed on the sidelines, waiting for “clarity” on trade policy that never came. Meanwhile, price, which is the only thing that pays, kept moving higher.

The Result: +19% in 7-Months

Fast forward to December 26, 2025.

That reclaim wasn’t a fake-out. It was the start of a sustained uptrend. The S&P 500 never looked back, holding the 200DMA as support and climbing to 6,929.95.

Entry (May 23): 5,802

Current (Dec 26): 6,929

Total Gain: +19.4%

Investors who waited for macro clarity missed nearly 20% gains in just over half a year. Those who trusted the technicals, specifically the 200DMA reclaim combined with breadth, captured the move.

Historical Performance of Reclaims

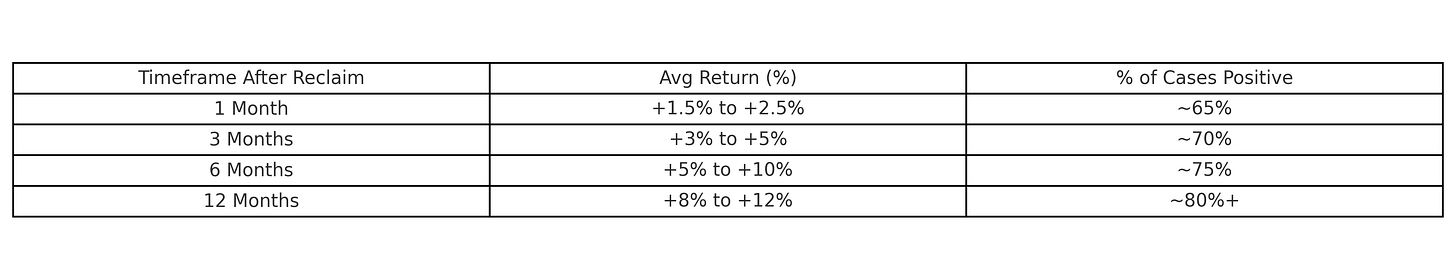

The May 2025 event wasn’t an anomaly. Historical data supports the bullish bias of this signal.

(Note: Table below reflects historical probabilities of forward returns after a confirmed 200DMA crossover)

What to Watch For Next

If you missed the May entry, don’t chase blindly. Instead, use the 200DMA as your risk management guide.

The “Checkback”: Often, after a strong rally, the index will pull back to test the 200DMA. If it bounces, that is a secondary entry point.

Breadth deterioration: If the market keeps rising but fewer stocks are above their 200DMA (a divergence), be cautious.

Volume: Watch for heavy selling volume if the price approaches the 200DMA again.

Conclusion

The 200-day moving average is more than a line on a chart. It is a behavioral trigger for the market. The May 2025 case study proves that when technicals align (price, breadth, and momentum), they often override the bearish macro narrative.

Keep watching the levels, and let the price dictate your strategy.

Glossary

S&P 500: A stock index representing 500 large U.S. companies.

Breadth: The percentage of stocks participating in a move. Broad participation generally means a healthy market.

VIX: Volatility Index. This measures expected market turbulence.

MACD: A momentum indicator that tracks the convergence or divergence of moving averages.