Hybrid Asset Allocation for U.S. Market Cap Rotation: A Regime-Aware Framework

A Working Paper Extending the Keller–Keuning Hybrid Asset Allocation Model to Regime-Filtered U.S. Equity Capitalization Segments

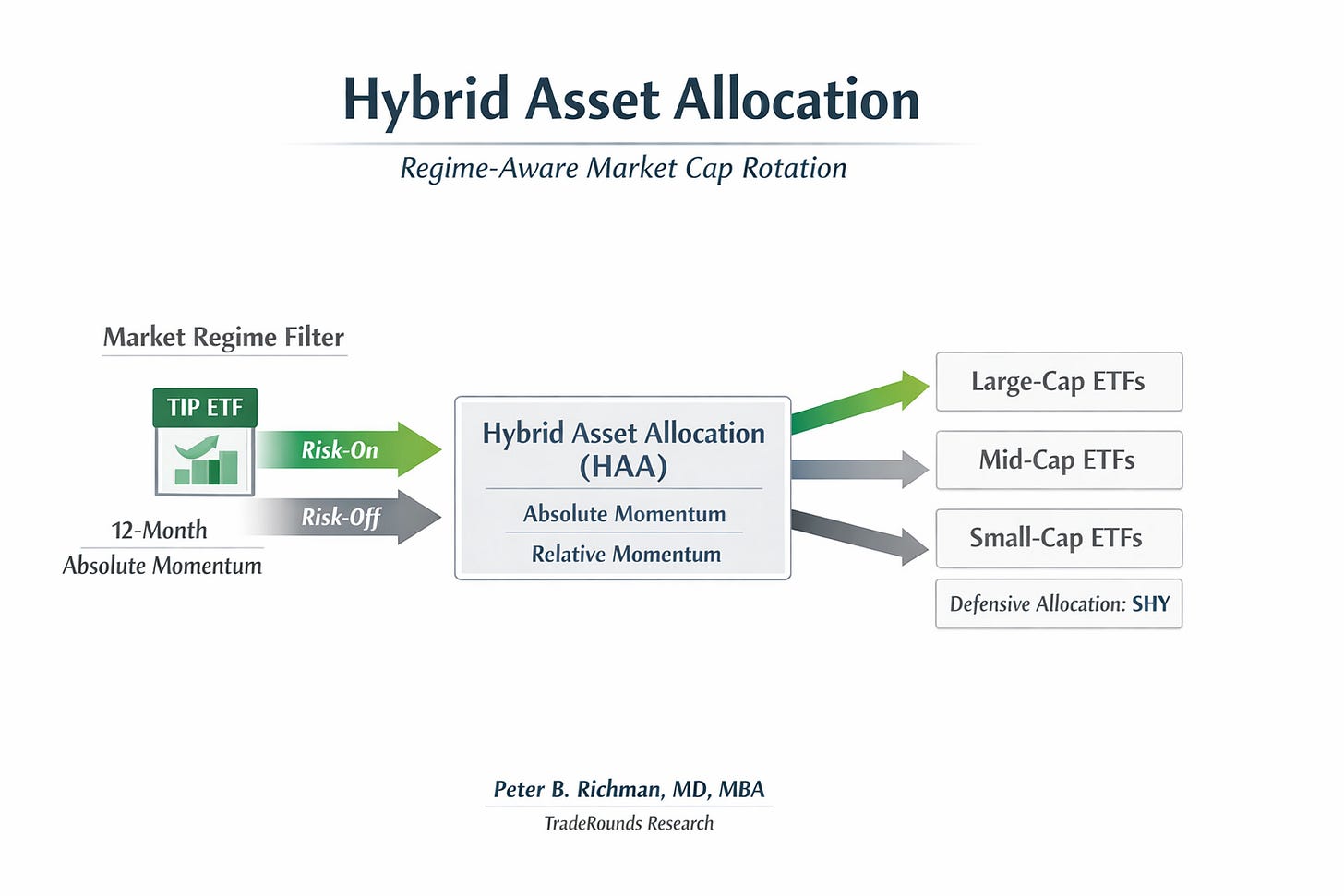

Hybrid Asset Allocation (HAA), originally developed by Keller and Keuning (2023), integrates absolute momentum and relative momentum within a regime-aware structure using a canary asset to determine market risk conditions. The framework has been widely discussed as a systematic approach to managing drawdowns while maintaining exposure to higher-return assets during favorable regimes.

In a new working paper, I extend the Hybrid Asset Allocation framework to U.S. market capitalization rotation, applying regime filtering to large-, mid-, and small-cap equity exchange-traded funds. Rather than relying on static exposure or single-lookback momentum signals, this approach evaluates both regime state and cross-sectional momentum when allocating across capitalization segments.

Specifically, the model combines:

Relative momentum measured across multiple horizons (1-, 3-, 6-, and 12-month lookbacks)

Absolute momentum of a Treasury Inflation-Protected Securities (TIP) canary asset to determine risk-on versus risk-off regimes

Short-term U.S. Treasury exposure (SHY) as the designated defensive allocation during adverse regimes

The objective of this research is not simply return maximization, but improved risk-adjusted performance and drawdown control across changing equity market environments. By incorporating regime awareness into market capitalization allocation decisions, the framework seeks to address the well-documented cyclicality of relative performance between large-, mid-, and small-cap equities.

The paper evaluates whether capitalization segments respond differently to regime filtering and whether a structured rotation approach can improve capital efficiency relative to static market exposure. The analysis is intended to contribute to the growing literature on regime-aware tactical asset allocation and extensions of the Hybrid Asset Allocation methodology.

The complete working paper is available on SSRN:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=6096427

Keywords: Hybrid Asset Allocation, Market Cap Rotation, Regime-Aware Investing, Tactical Asset Allocation, Absolute Momentum, Relative Momentum, ETF Rotation

References

Keller, Wouter J. and Keuning, Jan Willem, Dual and Canary Momentum with Rising Yields/Inflation: Hybrid Asset Allocation (HAA) (February 3, 2023). Available at SSRN: https://ssrn.com/abstract=4346906 or http://dx.doi.org/10.2139/ssrn.4346906

Richman, Peter, A Regime-Aware Market Capitalization Rotation Strategy Using Hybrid Asset Allocation Momentum (January 18, 2026). Available at SSRN: https://ssrn.com/abstract=6096427 or http://dx.doi.org/10.2139/ssrn.6096427